Introduction

It has been over a year since central banks began combating inflation and an overheating economy by raising interest rates. While economists debate whether Europe is in a recession, one thing is evident: the climax of economic conditions has passed, marking the onset of an inevitable slowdown. In line with the cycle theory, the real estate market stands among the sectors initially impacted by this economic deceleration. This trend is visible through real estate companies and beneficiaries across the globe facing bankruptcy, while other businesses grapple with emerging financial challenges.

Each country, driven by distinct internal economic factors and regulatory frameworks, undergoes a unique path during this phase. Given this context, how might Austria's real estate market respond in the upcoming 2024? This article aims to provide insights and valuable information for individuals and potential investors looking to take part in Austria's residential and office markets.

Residential Overview

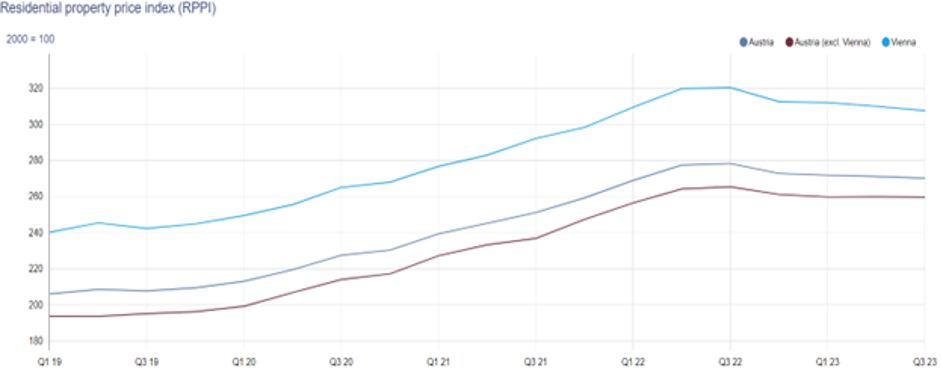

The chart below provided by the Austrian National Bank gives information on the development of residential real estate prices from Q1 2019 up to Q23 2023. What can be observed is that beginning from Q3 2022, one quarter after the initial interest rise, housing prices start to drop. By far, the largest decline is registered in Vienna, close to a 4% drop - from 320 to 308, while Austria (excl. Vienna) has experienced a 2% decline (265 to 260).

Source: Oesterreichische Nationalbank (OeNB)

According to a CBRE market report for the second half of 2023, further price deflation is necessary to make real estate an attractive investment when comparing it to the risk-free 10-year Austrian government bonds. For the record, the latter is currently at 4.34%, while the average rental yield return for properties is 3.70%.

Office Overview

In terms of office investment returns, similarly to the residential return rate, Modesta group reports a 3.50% yield for prime office locations. However, the yield for B locations ranges between 4% to 6%. What is also interesting to note is the fact that vacant office space is at a historically low level.

Overall, both office and residential properties are in a similar state investment-wise. To explain what could drive the real estate sector in 2024, let's take a look at the demand and supply factors at play.

Demand For Residential

Beginning with the demand side, one of the main factors impacting the current environment is the fact that the ECB is going to maintain interest rate levels unchanged until mid-2024. Additionally, the effects of the restrictive financial policy could be prolonged until later in the end of 2024 and may even echo in 2025. Studies on the matter suggest that financial policy actions carry a lagged effect on the real economy ranging between a year and eighteen months ahead in time.

Mortgage rates

High-interest rates translating into escalated mortgage costs impair new housing demand. Currently, the proportion of the net income required to meet new monthly mortgage installments is above the 30% golden ratio, as highlighted in a 2023 report by Raiffeisen Bank.Hence, it is no surprise that the mortgage market is in decline at the moment. What can improve demand is if economic activity expands. Forecasts for Austria’s GDP by the EU anticipate a 1% growth in 2024 and a 1,3% increase in 2025, which could lead to lower unemployment and steadily increasing wages. In combination with slightly falling, or even fluctuating property prices, this can create fresh interest in mortgage products and property acquisitions.

Shifting Preferences, Increasing Rents, and Inflation

Nonetheless, for the time being, mortgages continue to be less affordable than pre-2022, making renting more preferrable than ownership. Another argument for rising rents is that inflation tends to get sticky and indexed into the rental prices. Therefore, the increased demand for rentals, along with the potential decline in housing prices, is anticipated to result in higher returns on property investments. This trend might pave the way for active demand for residential property purchases in the future. Still, in the short to mid-term, the dominant trend seems to lean towards rental demand, as renting remains less expensive than owning.

Population

Lastly, the demographic factor cements the case for the strong upcoming demand in the residential real estate market down the road. Although this factor unfolds within a longer period, the stable demographic Austrian structure gives stability and boosts confidence in the real estate market, as forecasts from Statistics Austria

Demand For Office Space

As mentioned, the situation on the demand side for the office real estate market resembles the one in the residential market, with some nuances to keep in mind. The challenging macroeconomic landscape with rising prices and less consumer spending is creating financial constraints for businesses, as companies are focused on downsizing, optimizing costs and efficiency. More ESG-compliant, modern and hybrid spaces are in demand. Despite this trend, the historically low vacancy of 3.8% in Vienna for 2023 reported by Modesta is indicative of the overall strong demand for renting. The potential for further rental growth remains, as experts believe the highest rent increase should be experienced in the class A and class B office spaces. However, other rental submarkets might also grow, considering the inflation indexation factor.

Supply For Residential

Onto the supply, the chart below gives information about the residential building permits from 2005 up to Q1 2023. What can be observed in recent years is that the trend for new building permits is in a constant downtrend from 2021 onwards. The reduction in building permits will persist over the next quarters. Firstly, due to more expensive financing for construction companies and the increased construction costs. And secondly, developers would be cautious about adding new stock to the market when prices are falling.

Looking at the period from 2010 until 2020, one can’t help but notice the increase in permits and the substantial amount of stock added to the Austrian housing inventory. However, worries of oversupply seem unfounded. Rather, it is a supply-side response of the market acting to the strong demand for residential buildings. The Austrian real estate market prices were trending for eighteen consecutive years – one of the longest positive real estate cycles worldwide. Naturally, during an economic decline, there could be individuals and investors forced to liquidate their properties. As a result, this should make prices go down. However, big sell-offs sales are not likely to happen.

Supply For Offices

On top of the historical office vacancy rate, there is an insufficient supply of new offices coming into the market this year. Experts like CBRE and EHL state that the scarcity of available office space in Vienna is underscored by the fact that approximately 50% of the office space planned for completion in 2023 has already been pre-leased, intensifying the tension in the market. To mitigate this shortage, some transactions are shifting towards pre-letting projects planned for 2024/2025. In such an environment, it would be no surprise that once the economy recovers, the office sector will be one of the real estate markets leading recovery and stabilizing rental prices. Meanwhile, the shortage of new office spaces definitely adds to the imbalance between supply and demand forces, implying that there could be a prolonged and sustained increase in office rental prices in the coming years.

Conclusion

In summary, the Austrian real estate market is navigating a phase of economic (and price) adjustment, responding to financial challenges. There are no signs of a sudden market drop. Instead, we expect a gradual shift, with a predicted yearly correction staying within a single-digit percentage range. While the market adapts, 2024 should offer diverse opportunities in front of potential investors for discounted deals in the residential housing market. Additionally, high-end properties - both office and residential, are expected to remain resilient and maintain value with lower than market average discounts. Furthermore, the two markets foresee continued rental growth, offering potential for strategic investment. The landscape shapes a favorable environment for beneficial investments in the evolving Austrian real estate market.

Recommendations for Residential Investment Buyers

Monitoring the market for the next few quarters is recommended. Further housing price adjustments are expected, potentially offering discounted deals in the market. Staying informed about market trends, financing conditions, demand-supply dynamics, and policy actions is going to be beneficial. Observing rental growth in desired locations should bring some additional market insights.

Recommendations for Residential Home Buyers

For those contemplating buying a home, all the suggestions about the investors apply in full force. Moreover, home purchase can be a more emotional process. Making informed decisions without rushing is key. It is also an advantageous position because while waiting for a favorable deal, the rental market provides a more cost-effective alternative for accommodation.

Recommendations for Residential and Office Renters

Flexibility in lease agreements holds value amidst potential market adjustments. Monitoring rental rates in desired locations and locking rental contract agreements earlier could be beneficial for both residential and office renters. Dunaj Family Office Consulting is happy to assist you with your home purchase or your investment strategy. Contact us - our team is at your service.

Still in doubt whether to consider Austria as a country to live or invest in? Read this article to decide.